Building momentum: Manufacturing’s role in America’s next expansion.

The U.S. manufacturing industry has entered a phase of measured, but meaningful growth. Output and investment are trending upward, even as employment gains lag and firms continue to wrestle with hiring and skills gaps. Construction of manufacturing facilities is one of the clearest bright spots in the current cycle, supported by multi-year projects in semiconductors, batteries, food processing, HVAC equipment and data centers.

This report examines manufacturing through the lens of construction and capacity expansion, focusing on demand, production, labor, orders and regional trends. It highlights four sub-industries closely linked to facility spending and provides a grounded outlook for the next 12–18 months.

A resilient sector in transition.

Manufacturing remains a critical pillar of the U.S. economy. According to data cited by the National Association of Manufacturers (NAM), manufacturing contributed 9.7% of U.S. GDP, about $2.9 trillion in value added, and supported roughly 13 million jobs. Manufacturers also account for more than half of private-sector R&D spending, underscoring the sector’s role in innovation.

Text-Friendly Version (figure 1) opens in a new windowPDF footnote

After the shocks of the pandemic era (supply-chain disruptions, volatile input costs and staffing shortages), manufacturing is settling into a more stable trajectory. The story now is less about bounce-back and more about reinvention: Plants are being modernized, digital controls and automation are more widely adopted, and facility construction has surged.

One important indicator is manufacturing-related construction. Census Bureau data shows that total private manufacturing construction spending (all categories) reached an annual rate of about $220 billion in late 2025, more than double its level at the end of 2021. Treasury analysis of the same data notes that real manufacturing construction outlays have roughly doubled since late 2021, driven primarily by computer, electronics and electrical equipment facilities opens in a new window.

Text-Friendly Version (figure 2) opens in a new windowPDF footnote

At the same time, the Federal Reserve’s industrial production figures shows manufacturing output opens in a new windowPDF footnote moving sideways to modestly higher rather than booming. Through the third quarter of 2025, the industrial production index for manufacturing showed only a slight increase over recent months. This combination (strong construction outlays and modest current output) suggests companies are building for future demand and resilience rather than responding solely to near-term spikes.

The 2025 economic backdrop.

Output and production.

Federal Reserve data shows that overall industrial production in manufacturing has been relatively flat to slightly positive over the past year, with output in August 2025 up 0.9% from a year earlier. Within that total, machinery and electrical equipment production indices hover near their pre-pandemic baselines opens in a new window.

Text-Friendly Version (figure 3) opens in a new windowPDF footnote

The takeaway: Plants are busy but not overheated, and most of the dramatic changes are happening on the investment side — new facilities, new lines and technology upgrades — rather than in headline production growth.

Demand and orders.

The Institute for Supply Management’s Manufacturing PMI registered an upward trend mid- 2025 opens in a new window, indicating contraction in U.S. manufacturing activity for consecutive months. New orders components have been especially soft, reflecting caution in some capital goods and consumer durables markets.

At the same time, durable-goods data from the Census Bureau show that backlogs in several capital equipment categories, such as industrial machinery, electrical equipment and transportation components, remain elevated compared to pre-pandemic levels, suggesting manufacturers still have work in the pipeline even as new orders cool.

Replacement cycles continue to support demand. Many companies in food production, automotive, logistics and materials handling kept older equipment running longer during the pandemic and early recovery period. As these assets reach end-of-life, deferred replacement is sustaining orders for machinery, electrical equipment and HVAC systems.

Employment and labor.

According to Bureau of Labor Statistics (BLS) data summarized by NAM, manufacturing employment in late 2025 stood at about 12.8 million opens in a new window, modestly below year-earlier levels. Yet job openings remain elevated by historical standards: NAM recently reported roughly 409,000 open manufacturing positions, even after a recent decline.

Text-Friendly Version (figure 4) opens in a new windowPDF footnote

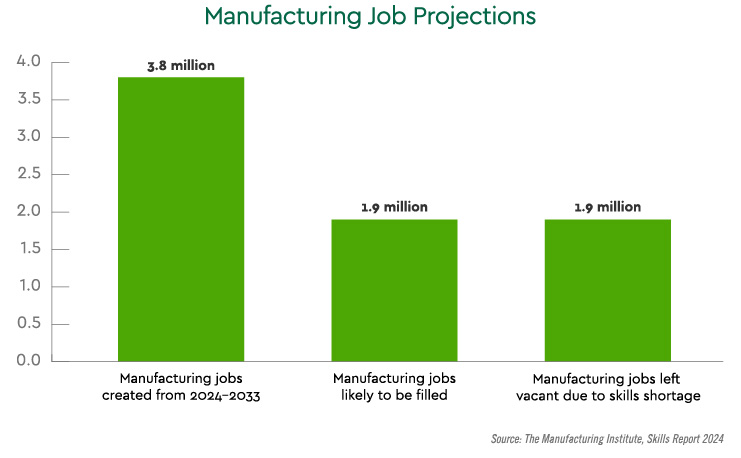

Looking ahead, NAM’s Manufacturing Institute and Deloitte project that the U.S. will need to fill about 3.8 million manufacturing jobs opens in a new window by 2033, with as many as 1.9 million potentially going unfilled if current trends persist. Persistent skills gaps in production, maintenance and advanced manufacturing roles are shaping investment decisions and accelerating the adoption of automation.

On the productivity front, BLS reports that manufacturing labor productivity opens in a new window rose 2.5% mid- 2025 compared with a year earlier, while unit labor costs increased by 2.0%. That pattern (productivity gains running slightly ahead of labor-cost growth) is consistent with gradual technology adoption and process improvement rather than purely head count-driven expansion.

Construction and capacity.

Census data shows manufacturing construction opens in a new window — especially in high-tech categories — at historically elevated levels. Private manufacturing construction outlays in recent reports were roughly 175% higher than at the start of 2020, according to analysis of Census figures.

Data center construction has been even more dramatic. Census series tracking construction in the “data center” category indicates that spending has risen nearly 400% since the beginning of 2021, with annualized outlays in 2025 several times higher than pre-AI levels. This boom feeds directly into demand for electrical equipment, HVAC systems and specialized construction services.

Taken together, these trends point to a sector that is investing heavily in long-lived assets (plants, clean rooms, cold-storage warehouses and AI-ready data centers) despite only modest near-term growth in output.

Four sub-industries driving construction-linked growth.

Beneath the top-line numbers, four manufacturing segments stand out for their links to construction and capacity expansion: machinery, electrical equipment, food and beverage and HVAC equipment. All four show substantial nominal growth since 2020 in Bureau of Economic Analysis (BEA) GDP-by-industry data and sit at the center of current facility-building trends.

Machinery manufacturing.

BEA data shows that machinery manufacturing opens in a new window generated about $208.6 billion in nominal value added in 2024, up from roughly $150.1 billion in 2020 — an increase of about 39% over four years. In real (inflation-adjusted) terms, output in 2024 was roughly 5% above its 2020 level, though still below its 2021 peak.

Text-Friendly Version (figure 5) opens in a new windowPDF footnote

Growth is broad-based across agricultural, construction, energy, industrial and material-handling equipment. Key demand drivers opens in a new window include the following:

- Agriculture and energy: Ongoing needs for high-horsepower tractors, combines, drilling rigs and related equipment.

- Infrastructure and construction: Elevated public works and private construction spending, including grid, road, pipeline and port projects.

- Automation and robotics: Expanded use of automated material-handling systems, machine-tool upgrades and factory automation lines.

On the investment side, machinery-intensive projects, such as automated distribution centers and large process plants, require facilities with heavy-duty foundations, high-capacity power, craneways and extensive testing bays. These features show up in higher-value construction projects and long planning horizons, making machinery manufacturing a forerunner for multi-year capital commitments.

Electrical equipment manufacturing.

Electrical equipment, appliance and component manufacturing has posted similar nominal gains. BEA figures opens in a new window show value added rising from about $57.7 billion in 2020 to roughly $80.2 billion in 2024 — an increase of nearly 40%. Real value added in this sector registered about $50.5 billion opens in a new window (chained 2017 dollars) in 2024, modestly above its level a year earlier and below its 2021 high.

This sector sits at the nexus of several mega-trends:

- Grid modernization and resilience: Utilities and grid operators are investing in transformers, switchgear, relays, storage and protection systems to harden networks, integrate renewables and support electrification.

- EV and battery facilities: New lithium-ion and next-generation battery plants, many in the Midwest and Plains states, require large volumes of power-distribution and process-control equipment.

- Data centers and AI: Large-scale data campuses opens in a new window tied to cloud and AI workloads rely on UPS systems, switchgear, substations and busway systems capable of supporting heavy continuous loads.

- Semiconductor fabs: Multi-billion dollar fabs under construction in Arizona, Ohio, Texas and other states require extensive power distribution, backup and clean-power systems, providing long-tail orders for electrical manufacturers.

BLS data shows opens in a new window employment in electrical equipment, appliance and component manufacturing at roughly 406,000 workers in mid-2025, with steady, though not explosive, job growth. The combination of strong nominal GDP growth and modest employment gains underscores the role of productivity, automation and higher-value product mixes.

Food and beverage manufacturing.

Food, beverage and tobacco products are often overlooked in discussions of advanced manufacturing, yet BEA data shows real value-added rising from about $271.4 billion in 2020 to roughly $296.6 billion in 2024 (chained 2017 dollars) — an increase of around 9%. This growth has been relatively steady compared with more cyclical sectors.

On the construction side, activity is concentrated in these areas:

- Food-processing plants and cold storage: Numerous projects in states such as California, Texas, Oklahoma, Iowa and Wisconsin are expanding meat, dairy, grain and specialty food processing capacity, often paired with large cold-storage warehouses.

- Automation and food safety: Producers are investing in advanced packaging lines, robotics, and data-driven quality systems to meet evolving food safety standards and retailer requirements.

- E-commerce grocery and last-mile logistics: Growth in online grocery and meal-kit services is spurring construction of high-throughput, temperature-controlled fulfillment centers that blend processing, packaging and distribution functions.

These projects tend to be capital-intensive: Cold-chain facilities require specialized insulation, racking, automation and environmental controls with long useful lives, anchoring regional clusters around major food brands such as Tyson Foods, Cargill and Nestlé.

HVAC equipment manufacturing.

HVAC and refrigeration equipment manufacturers sit at the intersection of construction, climate policy and efficiency standards. While U.S. national accounts data aggregate HVAC equipment across several industries, industry research indicates sizable market growth:

- MarketsandMarkets opens in a new window estimates the global HVAC system market at roughly $290 billion in 2024, with growth expected to continue through the decade.

- IBISWorld opens in a new window reports that U.S. revenues in the “Heating & Air Conditioning Equipment Manufacturing” industry are about $63 billion in 2025.

Recent census visualizations show shipments and new orders for U.S. HVAC and refrigeration equipment opens in a new window trending higher than in 2023, supported by commercial retrofits, new construction and replacement of aging residential systems.

Key demand drivers include the following:

- Building upgrades: Schools, distribution centers, office buildings and healthcare facilities are upgrading systems to improve indoor air quality and energy efficiency, often tapping federal and state incentives.

- Residential replacement cycles: Many installed HVAC systems in the U.S. are 15–20 years old; tightening efficiency standards opens in a new windowPDF footnote and refrigerant rules are prompting accelerated replacement.

- Smart and connected systems: HVAC manufacturers are integrating IoT sensors, remote monitoring and smart controls, which in turn require more sophisticated manufacturing processes and electronics integration.

These trends are driving new facilities and expansion projects in states such as Tennessee and the Carolinas, where HVAC manufacturing is already concentrated, as well as in Kansas and other central locations with good logistics and workforce access.

Key industry dynamics.

With the sub-industry context in place, four cross-cutting dynamics help explain where manufacturing is headed.

1. Investment in facilities and capacity.

Manufacturing-related construction spending opens in a new window is surging forward. Census C-30 data and Federal Reserve analysis both highlight a pronounced shift since 2020 toward building new manufacturing facilities rather than simply sweating existing assets.

- Manufacturing construction outlays have risen sharply opens in a new window since 2020, with especially rapid growth in computer, electronics and electrical equipment plants.

- Data center construction, often co-located with or adjacent to manufacturing and logistics hubs, has nearly quadrupled since 2021.

This wave of projects reflects a shift toward capacity designed for supply chain resilience (on-shoring/friend-shoring), electrification, automation and AI-enabled operations.

2. Productivity and digital transformation.

As noted earlier, BLS data shows manufacturing productivity rising faster than overall hours worked and employment. Year-end data shows manufacturing labor productivity grew by 2.5%, while unit labor costs increased by 2.0%.

Behind those figures are several forces worth noting:

- Automation and robotics are expanding in material handling, welding, packaging and inspection, increasingly including collaborative robots opens in a new window that work alongside people.

- Data and analytics, including digital twins, predictive maintenance and real-time quality monitoring, are influencing how new plants are designed and operated.

- AI-enabled machine vision is improving defect detection in food processing, electronics and precision components, supporting tighter tolerances and reduced scrap.

These technologies have construction implications: New facilities must accommodate higher power densities, robust data networks, robotics-friendly layouts and specialized environmental controls. As a result, many firms find it more economical to build new plants than to retrofit older, constrained sites.

3. Labor and talent.

Even with modest net job growth, the labor challenge remains central. NAM’s Manufacturing Institute opens in a new window projects that 3.8 million manufacturing jobs will likely need to be filled by 2033, with about half of those jobs potentially going unfilled without stronger pipelines.

Text-Friendly Version (figure 6) opens in a new windowPDF footnote

Employers are responding through a few key actions:

- Expanded apprenticeships and earn-while-you-learn programs

- Partnerships with community colleges and technical schools

- Upskilling initiatives focused on automation, maintenance, data and quality

NAM’s Outlook Survey opens in a new window for mid-2025 notes that attracting and retaining talent is the top business challenge for nearly half of manufacturers. The gap between available workers and open roles, especially in technical and maintenance fields, is narrowing but still meaningful.

Text-Friendly Version (figure 7) opens in a new windowPDF footnote

Regional labor conditions are increasingly influencing how manufacturers approach hiring. In states where technical education systems are well developed and manufacturing activity is concentrated, such as Tennessee, the Carolinas and parts of the Midwest, companies benefit from stronger workforce pipelines and more consistent access to training partners. These regions have combined community college networks, employer coalitions and targeted state incentives to help manufacturers attract and retain skilled technicians, maintenance specialists and production workers. As a result, employers in these areas are often able to fill critical roles more quickly and maintain steadier staffing levels compared with regions without similar infrastructure.

Text-Friendly Version (figure 8) opens in a new windowPDF footnote

Many manufacturers are also expanding internal workforce development programs to strengthen skills and improve retention. Some companies now operate their own training centers offering instruction in areas such as industrial robotics, programmable controls, mechatronics and quality systems. Findings from The Manufacturing Institute opens in a new windowPDF footnote and ARM Institute opens in a new window show that firms with structured training pathways often see better retention, faster onboarding and higher productivity. Other employers are building career-progression frameworks that combine mentorship, cross-training and credentialing to support long-term employee growth and ensure teams can adapt to new technologies and production methods.

Even with these initiatives, manufacturers continue to face wide gaps between open positions and available workers, especially in technical, maintenance and automation-related roles. BLS data opens in a new window and industry surveys show persistent difficulty filling these positions despite rising investments in training. To manage these constraints, many companies are accelerating adoption of automation, predictive-maintenance tools and digital production systems. These technologies help stabilize output and reduce unplanned downtime, but they also increase the need for workers with advanced skills. As a result, talent strategy remains a central factor in manufacturing’s ability to sustain growth in the coming years.

4. Orders, inventories and supply-chain reset.

Census “M3” data opens in a new window on manufacturers’ shipments, inventories and orders show that while new orders in some industries have cooled from 2021–2022 highs, order backlogs and inventory strategies remain structurally different from the pre-pandemic era.

Many manufacturers have moved from lean “just-in-time” inventory models to more resilient “just-in-case” approaches for critical components such as semiconductors, specialty metals and battery materials. Facility construction is part of this redesign: companies are building plants closer to end markets, major freight corridors and supplier clusters to reduce logistics risk and lead-time volatility.

Regional strength and emerging clusters.

Regional manufacturing patterns opens in a new window matter more than ever because new plants, supplier ecosystems and workforce programs tend to cluster. Regional variations opens in a new window in manufacturing performance are becoming more pronounced as companies gravitate toward locations that can best support their long-term growth strategies. The quick look reveals several important points:

- Traditional hubs such as California, Texas, Ohio and Michigan remain heavyweights in overall manufacturing jobs and value added.

- The Midwest and Great Plains (including Indiana, Kansas, Nebraska and Oklahoma) are seeing a mix of machinery, food processing, electrical equipment and logistics-related projects, leveraging central geography and transportation networks.

- The Southeast (Tennessee and the Carolinas) is emerging as a major corridor for HVAC equipment, automotive components and electrical systems, supported by favorable business climates and robust technical college pipelines.

- The Southwest and Mountain West (Arizona, Texas, Utah and Nevada) have become focal points for semiconductor fabs, battery plants and advanced manufacturing projects that require large footprints and sophisticated infrastructure.

Text-Friendly Version (figure 9) opens in a new windowPDF footnote

In the Midwest, the manufacturing base continues to diversify beyond its traditional automotive roots. States such as Indiana, Ohio and Wisconsin are experiencing activity in machinery, electrical equipment and food products as companies leverage the region’s industrial workforce and transportation networks.

The Great Plains (Kansas, Nebraska, Oklahoma) have become increasingly attractive for both traditional manufacturing and new-economy sectors such as electrical equipment and advanced food processing. Manufacturers cite the region’s central logistics position, stable operating costs and concentration of specialized suppliers as key advantages.

The Southeast remains one of the fastest-growing corridors for manufacturing expansion. Tennessee and the Carolinas have seen substantial growth in HVAC equipment, automotive components and electrical systems. These states combine favorable business climates with strong technical colleges and growing industrial workforces.

Meanwhile, western states such as Arizona, Utah and Nevada are benefiting from semiconductor-related investment, aerospace growth and advanced manufacturing projects that require large footprints and specialized infrastructure.

These regional clusters create virtuous cycles: Once a critical mass of plants is in place, suppliers follow, workforce initiatives ramp up and additional construction becomes more attractive.

Looking ahead: 2026–2027 outlook.

Rather than anchoring on single-point forecasts, it’s helpful to think in scenarios:

- Baseline: Continued moderate growth in manufacturing output, with low single-digit real gains supported by ongoing construction of factories, data centers and logistics facilities.

- Upside: Easing interest rates and stronger global demand could unlock additional capital spending, particularly in infrastructure-linked sectors such as electrical equipment, machinery and HVAC.

- Downside: A sharper consumer slowdown or an extended inventory correction could weigh on orders in some industries, though long-cycle investments in semiconductors, the energy transition and data centers would likely keep many large projects on track.

Across scenarios, several themes appear durable:

- Construction-linked investment — factories, data centers, cold storage and advanced equipment plants — remains a primary growth engine.

- Productivity and automation gains help offset wage and materials pressure and magnify the impact of new capital.

- Labor markets stay tight for specialized skills, even if overall hiring slows.

- Supply chain resilience, regional clustering and digital infrastructure remain at the center of plant-siting decisions.

In short, U.S. manufacturing looks positioned for moderate, sustained expansion built on capacity, technology and regional ecosystems rather than a short-term boom in output. For lenders, owners and project teams, that means manufacturing-related construction is likely to remain a core driver of opportunity over the next several years.

Disclosures:

To view or print a PDF file, Adobe® Reader® 9.5 or above is recommended. Download the latest version opens in a new window.